tax service fee fha

Average property tax in California counties. Advertiser Disclosure Close.

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Verification of Mortgage VOM or Verification of Payment VOP Borrowers Authorization.

. Its pretty simple actually. Upfront Mortgage Insurance Fee 1 of loan amount. That reduced our list to four.

We included only online tax software companies that provide free tax preparation for simple tax filings for federal and state tax returns. To apply for an FHA-insured loan you will need to use an FHA-approved lender. Federal income tax records for last two years.

This fee called FHA Mortgage Insurance Premium MIP is a type of insurance that protects lenders against loss in case of a foreclosure. TurboTax TaxSlayer HR. The FHA doesnt lend money to people.

The tax is added to the price of the item or service and is included in the total cost for the buyer. LLPA Rate Extensions Tax Service Note. Attorney fees title insurance appraisal fees inspection fees underwriting fee and other possible miscellaneous fees.

All financial products. We think its important for you to understand how we make money. Search for an FHA-approved lender here.

Annual Mortgage Insurance Rate. An FHA loan is a government-backed conforming loan insured by the Federal Housing Administration. If there is no consistent two-year history of doing extra work outside the employer it wont likely.

The offers for financial products you see on our platform come from companies who pay us. If you did not provide a list or redisclosed for a shopable fee without a new provider list option the fees will be 10 tolerance. The State of California Tax Franchise Board notes that for tax year 2020 households making up to 30000 could qualify for a tax credit of up to 3026.

How do I apply for an FHA loan. The amount you can deduct should be included in box 5 of your mortgage tax form titled Form 1098. A sales tax is a point-of-purchase levy that is paid by consumers who buy the taxed goods and services within the borders of the taxing authority.

Government-backed loans typically cover the risks and defray the costs of their programs by charging mortgage insurance funding fees or guarantee fees. Any fee which is charged by creditor or investor is by proxy considered charged by an originator and disclosed in Section A. Can these companies help me.

For 2020 tax returns filed in 2021 the standard deduction is 12400 for individuals 18650 for heads of household and 24800 for married couples filing jointly and surviving spouses. Use this FHA mortgage calculator to get an estimate. Learn more about FHA loans.

The maximum FHA lending amount in 2019 for lower-cost areas is 314827 and is up to 726525 for high-cost areas. In the US the authority is a state and sometimes a county or city. FHA charges an upfront mortgage insurance premium UFMIP.

As a free service we can help you determine the maximum mortgage amount for which you could qualifyIf you wish we can also secure a no-obligation pre-qualification letter from a lender in your area who will guarantee your loan request and lock the lowest possible rateThis is a free service available to US citizens above the age of eighteen. With FHA loans those pesky mortgage insurance premiums will remain in place until you pay the mortgage off or refinance into a conventional loan. The letter indicates that I can receive this unclaimed property if I pay a finders fee.

Service provider or specific products site. You can check its website for 2021 updates. Tax-deductible costs may include.

Several companies or locator services engaged in the business of identifying and recovering unclaimed assets for profit acquire federal check issuance data from Fiscal Service and various federal government agencies under. It insures mortgage loans from FHA-approved lenders against default. In 2010 one.

These fees can sometimes be financed and added to the mortgage amount. Are you an existing Freedom Mortgage customer with a question about your account. An HECM insured by the Federal Housing Administration FHA is the most common kind of reverse mortgage.

In other words you cannot buy a house that exceeds the amounts specified by the Department of Housing and Urban Development HUD. FHA loans have lower credit and down payment requirements for qualified homebuyers. 175 of loan amount.

Unlike FHA loans there are technically no set loan limits for USDA loans. We can assist you at. Proceeds from a reverse mortgage loan are usually tax-free and not a penny of the loan needs to be paid back if the borrower stays in the home pays property taxes and homeowners insurance and covers maintenance expenses.

With FHA loans there are specific guidelines for verifying income both for someone employed and self-employed. For instance the minimum required down payment for an FHA loan is only 35 of the purchase price. Find FHA loan products for manufactured mobile homes.

Employee of a company can get a paycheck on the 1 st and 15 th of the month and agree to perform some external work for a fee. As of 2020. FHA mortgage insurance and VA funding fees.

A percentage of each mortgage payment made by a borrower to a mortgage servicer as compensation for keeping a record of payments collecting and making escrow payments passing.

Pin On Private Mortgage Insurance Pmi

Who Pays What A Guide To Closing Costs Views Of La Jolla Home Buying Process Real Estate Real Estate Tips

Lived In Several States You May Have Lost Money Waiting For You Unclaimed Money Money Smart Week Lost Money

What Is The Minimum Credit Score For A Kentucky Fha Mortgage Home Loan Approval Buying First Home Home Mortgage First Home Buyer

Fha Loan Closing Cost Calculator

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

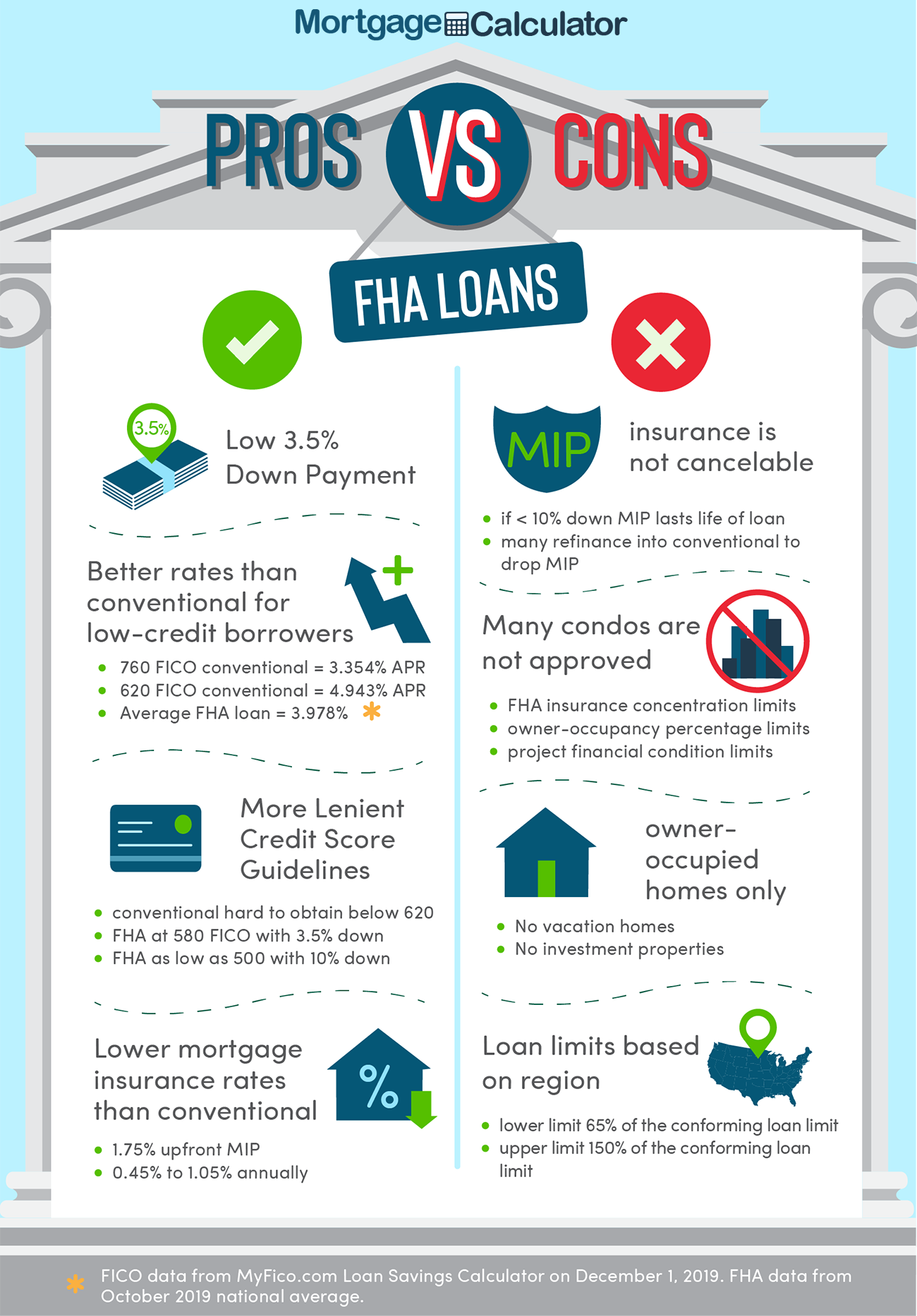

Fha Loans Vs Conventional Loans What S The Difference

Do S And Don Ts When Purchasing A Home Mortgage Refinance Firstimehomebuyer Jumbo Purchase Fha Conventiona Reverse Mortgage Refinance Mortgage Mortgage

Fha Closing Costs Complete List And Estimate Fha Lenders

Cheap Discount Mortgages Brokers Are Better In 2022 Mortgage Mortgage Banker Mortgage Brokers

A Complete Guide To California Fha Mortgage Fha Mortgage Pay Off Mortgage Early Mortgage Payoff

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

2022 Fha Qualifying Guidelines Fha Mortgage Source

Usda 580 Fico Up To 100 Ltv 102 Cltv Low Pmi Commercial Loans Cash Out Refinance Fha Loans

10 Tax Breaks When You Own A Home Infographic If You Re Searching For Information On Tax Benefits Of Owning A Home You Real Estate Buying First Home Estates

Did You Know That You Can Obtain A Mortgage Loan With A Score Of 580 Using The Fha Federal Housing Administration Loan There House Real Estate House Entrance

Reverse Mortgage Purchase Or Refinance No Payment No Income No Credit Required Reverse Mortgage Mortgage Companies Bad Credit Mortgage

Pin On Real Estate Is My Passion

Are You A First Time Homebuyer Needing A Little Help With Your Down Payment Or Closing Costs Ocmbc Has Just The Pr Closing Costs Mortgage Loans Mortgage Rates

:max_bytes(150000):strip_icc()/fhaloan.asp-V1-773ce9699c13471b9bf8f53e7d3824d5.png)